How to Trade Forex Using Correlations Between Currency Pairs

Home » How to Trade Forex Using Correlations Between Currency Pairs

Introduction

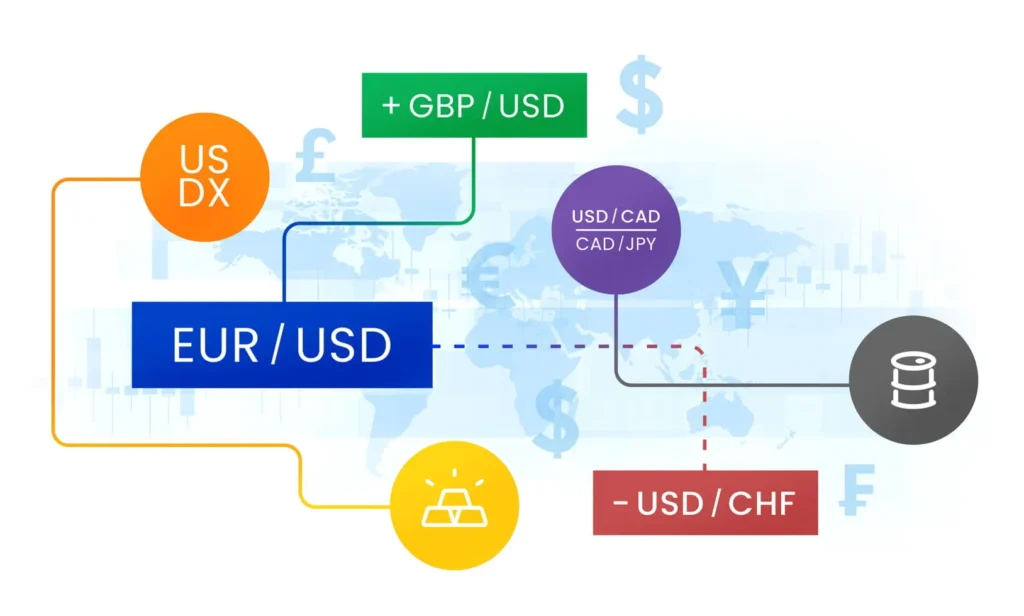

Did you know that some currency pairs move in sync while others move in opposite directions? This relationship, known as Currency Pair Correlation, is crucial for forex traders looking to optimize their strategies. Understanding these correlations can help you reduce risk, diversify your trades, and improve decision-making.

Imagine placing two trades on different currency pairs, thinking you’re diversifying, only to find both moving in the same direction—leading to double the risk instead of reduced exposure. This is why Forex correlation strategies are essential for traders who want to maximize profits while minimizing unnecessary risks.

In this guide, we’ll break down the concept of Currency Pair Correlation, explain how to measure it, and reveal trading strategies that leverage correlations for higher profitability.

What is Currency Pair Correlation?

Currency pair correlation refers to the degree to which two forex pairs move in relation to each other. It helps traders predict how different pairs might behave under similar market conditions.

There are three types of currency pair correlations:

1. Positive Correlation

A positive correlation means that two currency pairs tend to move in the same direction.

Example: EUR/USD and GBP/USD

- If EUR/USD rises, GBP/USD is also likely to rise.

- Both pairs share a strong connection because the Euro (EUR) and British Pound (GBP) are often influenced by similar economic events in Europe.

2. Negative Correlation

A negative correlation means that two currency pairs tend to move in opposite directions.

Example: EUR/USD and USD/CHF

- If EUR/USD goes up, USD/CHF usually goes down.

- This happens because when traders buy the Euro, they often sell the US Dollar, which strengthens the Swiss Franc.

3. No Correlation

Some currency pairs have little to no correlation, meaning their price movements are independent of each other.

Example: AUD/JPY and EUR/CAD

- These pairs move based on different economic factors and geographical influences.

Why Does Correlation Matter?

Understanding correlation helps traders avoid unnecessary risk by ensuring they aren’t overexposed to similar trades.

How to Measure Currency Pair Correlation

To trade forex effectively, you need to measure correlation using statistical tools. The most common method is the Correlation Coefficient, which ranges between +1 to -1:

| Correlation Value | Meaning |

|---|---|

| +1.0 | Perfect Positive Correlation (Moves in the same direction) |

| +0.5 | Strong Positive Correlation (Often moves together) |

| 0.0 | No Correlation (Moves independently) |

| -0.5 | Strong Negative Correlation (Often moves opposite) |

| -1.0 | Perfect Negative Correlation (Always moves opposite) |

Tools to Measure Correlation

- Forex Correlation Tables (Available on trading platforms like OANDA & Myfxbook)

- MetaTrader 4 & 5 Indicators

- Correlation Calculators (Online tools that show live correlation data)

Key Takeaways:

- Use correlation to hedge risks and protect your trades.

- Diversify your portfolio by selecting currency pairs with low correlation.

- Confirm trade signals with correlated pairs to enhance accuracy.

- Regularly monitor correlation coefficients as market conditions evolve.

By applying these strategies, you’ll gain a deeper understanding of the forex market and make more informed trading decisions.

Best Trading Strategies Using Currency Pair Correlation

Hedging Strategy (Minimizing Risk)

Hedging is a risk management technique where traders take opposite positions in negatively correlated currency pairs to protect their investments.

Example:

- You buy EUR/USD and sell USD/CHF at the same time.

- If one trade goes against you, the other trade will likely offset the loss.

Why Use It?

- Reduces overall trading risk.

- Protects capital during market volatility.

2. Diversification Strategy (Spreading Risk)

Diversification means trading multiple currency pairs with low or no correlation to spread risk.

Example:

- Instead of trading only EUR/USD and GBP/USD (both highly correlated), you can trade EUR/USD and AUD/JPY for more diversification.

Why Use It?

- Reduces the impact of market swings on your overall portfolio.

- Ensures that all your trades don’t lose money at the same time.

3. Signal Confirmation Strategy (Boosting Accuracy)

By analyzing correlated currency pairs, traders can confirm trade signals before executing their orders.

Example:

- If EUR/USD shows a buy signal, you check GBP/USD.

- If GBP/USD also shows a buy signal, this strengthens your trade confidence.

Why Use It?

- Reduces the chances of false signals.

- Increases trade accuracy and profitability.

Common Mistakes Traders Make with Currency Correlation

1. Over-Reliance on Historical Correlation

- Correlations change over time due to economic events. Always check recent data before trading.

2. Ignoring Fundamental Factors

Interest rates, political events, and market sentiment can impact correlation. Don’t rely solely on charts.

3. Over-Trading Correlated Pairs

Trading multiple positively correlated pairs increases exposure to the same risk.

Pro Tip: Always monitor economic news and market conditions that might shift currency relationships.

Real-World Examples of Currency Pair Correlation

Case Study: EUR/USD vs. USD/CHF

During the 2008 financial crisis, EUR/USD and USD/CHF showed a strong negative correlation because traders sought safe-haven assets like the Swiss Franc (CHF).

Brexit Impact on GBP/USD & EUR/USD

In 2016, the Brexit vote led to a sharp drop in GBP/USD, which also affected EUR/USD due to uncertainty in Europe.

Takeaway: Understanding real-world correlations helps traders anticipate market movements before they happen.

FAQs

You can use forex correlation tables, online calculators, or MT4 indicators to check correlation values.

Yes! Correlation shifts due to economic news, interest rate changes, and global market conditions.

The best approach is hedging to minimize risk and signal confirmation to improve accuracy.

Conclusion

Master Forex Trading with Correlation

Understanding Currency Pair Correlation is a game-changer for forex traders. By analyzing how different currency pairs move in relation to each other, you can reduce risk, improve trade accuracy, and enhance portfolio diversification.

Ready to elevate your forex trading strategy?

Sign up for complete forex trading assistance from Market Investopedia!

Share it now!

Ansel Girard

Ansel Girard is a forex trading expert specializing in technical analysis, price action, and market fundamentals. Passionate about trader education, he simplifies complex strategies into actionable insights.